Time Deposit Rates

View time deposit rates. 365 Days: 2 Years: 1K to less than 10K: 0.0000. Foreign Exchange / Time Deposit New Fund Offers: Enjoy +1% p.a. Bonus rate on top of prevailing rates by converting and placing time deposit with HKD30,000 (or equivalent) or above with New Funds. (applicable to designated currency) Remark:The above interest rates.

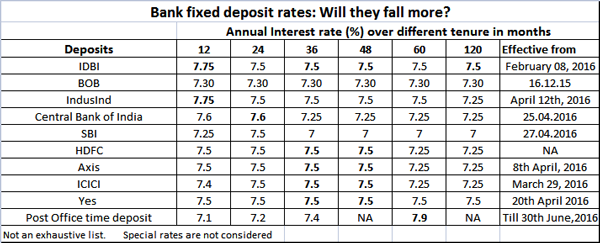

- The best CD rates tend to be at online banks and credit unions. Many banks dropped their rates on CDs in response to the Federal Reserve's emergency rate cuts in March 2020.

- Greenmarket Time Deposit; Term: 30-360 days: Interest Rate: Upon Maturity: Min. Deposit: USD 1,000: What our Customers Have to Say. Thank you, PNB, for your excellent service and for being my first.

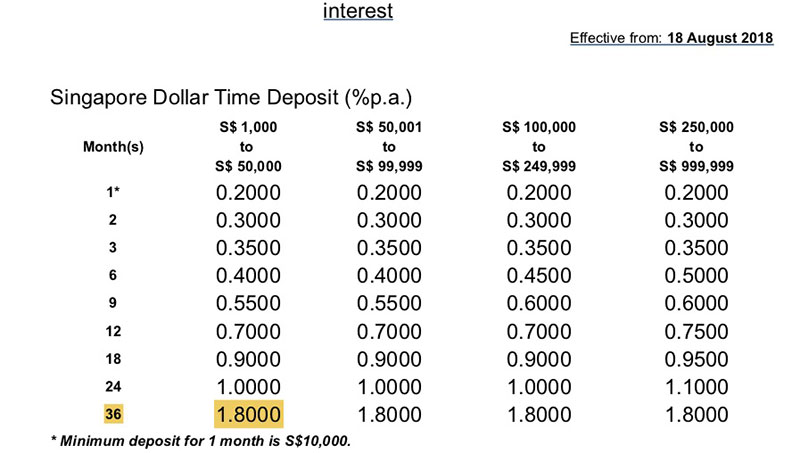

- Time deposit investment rates generally differ from interest range of 1.00% to 5.00%. Time Deposit Tenure Usually time deposit terms vary from 1, 2, 3, 6, 9 or 12 months.

Personal Banking Customers who have taken up Integrated Account Service and place a 3-month or 6-month 'New Fund Preferential Time Deposit' with 'Eligible New Fund Balance'* of HKD10,000 / USD1,000 / RMB10,000 or above via internet banking or mobile banking, can enjoy preferential annual interest rates as follows:

Wealth Management customers :

| Currency | 3-month | 6-month | Application Channel |

|---|---|---|---|

| HKD | 0.20% | 0.25% | Internet Banking, Mobile Banking |

| USD | 0.10% | 0.10% | |

| RMB | 1.50% | 1.55% |

Enrich Banking customers :

Time Deposit Rates Comparison

| Currency | 3-month | 6-month | Application Channel |

|---|---|---|---|

| HKD | 0.15% | 0.20% | Internet Banking, Mobile Banking |

| USD | 0.05% | 0.05% | |

| RMB | 1.45% | 1.50% |

i-Free Banking customers :

| Currency | 3-month | 6-month | Application Channel |

|---|---|---|---|

| HKD | 0.10% | 0.15% | Internet Banking, Mobile Banking |

| USD | 0.05% | 0.05% | |

| RMB | 1.40% | 1.45% |

Above preferential time deposit interest rate is quoted based on the time deposit interest rates of published on 6 March 2021 and is for reference only, customer can also contact BOCHK staff for updated preferential time deposit rate.

*“Eligible New Fund Balance” refers to the incremental balance when comparing the latest deposit balance with the balance of the same currency as of last month end, after deduction of the sum of principle amount of the same currency which has been entitled to all new fund offers of time deposit in current month. Time deposit new fund offer is applicable to sole name account only. The balance of all accounts, including Savings Accounts, Current Accounts and Time Deposits of the same currency of Sole name account will be counted towards the calculation of 'Eligible New Fund Balance'. In case of any dispute on the definition of 'Eligible New Fund Balance', the decision of BOCHK shall be final.

Example:

Latest deposit balance of a currency (A) | $200,000 |

Deposit balance of the same currency as of last month end (B) | $50,000 |

Incremental balance (A-B) | $150,000 |

Sum of principal amount of the same currency which has been entitled to new fund offer of time deposit in current month ( C ) | $30,000 |

Eligible new fund balance (A-B-C) | $120,000 |

Personal Banking Customers who have taken up Integrated Account Service and place a 1-month, 3-month, 6-month or 12-month Exisitng Fund Preferential Time Deposit of HKD10,000 / USD1,000 / RMB10,000 or above via internet banking or mobile banking, can enjoy preferential annual interest rates as follows:

Wealth Management customers :

| Currency | 1-month | 3-month | 6-month | 12-month | Application Channel |

|---|---|---|---|---|---|

| HKD | up to 0.05% | up to 0.15% | up to 0.20% | up to 0.35% | Internet Banking, Mobile Banking |

| USD | up to 0.01% | up to 0.05% | up to 0.05% | up to 0.10% | |

| RMB | up to 1.00% | up to 1.40% | up to 1.50% | up to 1.55% |

Enrich Banking customers :

| Currency | 1-month | 3-month | 6-month | 12-month | Application Channel |

|---|---|---|---|---|---|

| HKD | up to 0.05% | up to 0.10% | up to 0.15% | up to 0.30% | Internet Banking, Mobile Banking |

| USD | up to 0.01% | up to 0.05% | up to 0.05% | up to 0.10% | |

| RMB | up to 0.95% | up to 1.35% | up to 1.45% | up to 1.50% |

i-Free Banking customers :

| Currency | 1-month | 3-month | 6-month | 12-month | Application Channel |

|---|---|---|---|---|---|

| HKD | up to 0.05% | up to 0.05% | up to 0.10% | up to 0.25% | Internet Banking, Mobile Banking |

| USD | up to 0.01% | up to 0.05% | up to 0.05% | up to 0.10% | |

| RMB | up to 0.90% | up to 1.30% | up to 1.40% | up to 1.45% |

Above preferential time deposit interest rate is quoted based on the time deposit interest rates of published on 6 March 2021 and is for reference only, customer can also contact BOCHK staff for updated preferential time deposit rate.

Time Deposit Rates Bdo

Personal Banking Customers who have taken up Integrated Account Service place a time deposit of original currency 1,000 (AUD, NZD, GBP, CAD) / original currency 10,000 (RMB) or above by conversion of funds enjoying the preferential annual interest rates as follows:

| Deposit Tenor | Preferential Interest Rate (p.a.) | Application Channel | |||||

|---|---|---|---|---|---|---|---|

| AUD | NZD | GBP | CAD | RMB | USD | ||

| 7-day | 7.80% | 7.80% | 8.80% | 8.80% | 6.80% | 5.00% | Internet Banking, Mobile Banking |

| 1-month | 2.00% | 2.00% | 2.00% | 2.30% | 3.50% | 1.00% | |

Set up Preferential RMB & FX time deposit now via Internet Banking or Mobile Banking with just a few clicks:

Login to Internet Banking > Banking > Time Deposit > Deposit Placing > Select placement of Time Deposit (Preferential RMB and FX Time Deposit)

(Both FX exchange and deposit placement should be conducted at the same time)

Personal Banking Customers who have taken up Integrated Account Service place a time deposit of original currency $1,000 or above by conversion of funds enjoying the preferential annual interest rates as follows:

| Number of actual deposit days | Corresponding deposit period | Preferential Interest Rate (p.a.) | Application Channel | |||

|---|---|---|---|---|---|---|

| AUD | NZD | CAD | GBP | |||

| 1 day - less than 7 day | 1-day | 0.01% | 0.01% | 0.01% | 0.01% | Internet Banking, Mobile Banking |

| 7 days - less than 1 month | 7-day | 0.02% | 0.02% | 0.02% | 0.02% | |

| 1 month - less than 3 months | 1-month | 0.05% | 0.05% | 0.03% | 0.03% | |

| Until the maturity | 3-month | 0.20% | 0.20% | 0.10% | 0.10% | |

Set up FX time deposit now via Internet Banking or Mobile Banking with just a few clicks:

Login to Internet Banking > Banking > Time Deposit > Deposit Placing > Select placement of Time Deposit (Foreign Currencies Flexi Time Deposit)

Personal Banking Customers who have taken up Integrated Account Service placing a 7-day or 1-month Preferential HKD Time Deposit Offerwith conversion of AUD, NZD, GBP or CAD funds, enjoying the preferential annual interest rates as follows:

| Deposit Tenor | Preferential Interest Rate (p.a.) | Application Channel |

|---|---|---|

| HKD | ||

| 7-day | 4.00% | Branch, Internet, Mobile, Manned Phone Banking Services |

| 1-month | 1.00% |

Set up Preferential HKD time deposit now via Internet Banking or Mobile Banking with just a few clicks:

Login to Internet Banking > Banking > Time Deposit > Deposit Placing > Select placement of Time Deposit (Preferential HKD Time Deposit)

(Both HKD exchange and deposit placement should be conducted at the same time)

Terms of the promotion offers:

- The above offers are only applicable to personal banking customers of Bank of China (Hong Kong) Limited ('BOCHK') who have taken up Wealth Management, Enrich Banking or i-Free Banking service (“Integrated Account Service“).

- Time deposits should be set-up on banking business days of Hong Kong. Deposits may not be uplifted before maturity. For a call deposit, maturity refers to the expiry of your notice of the agreed period to BOCHK. BOCHK may permit an early uplift subject to payment of BOCHK losses, expenses and charges (in the amounts determined by BOCHK). No interest will be payable on the deposit if an early uplift is permitted. Interest on a deposit is only payable at maturity. A deposit, which would otherwise mature on a non-business day (like Saturday, Sunday or public holiday), matures on next business day.

- Manned Phone Banking Services are only applicable to selected customers with designated transaction account. For details, please contact our branch staff.

- The above products, services and offers are subject to the relevant terms. For details, please refer to the relevant promotion materials or contact the staff of BOCHK.

- The preferential time deposit interest rate in this promotion material is quoted based on the interest rates of Hong Kong Dollars, RMB and Foreign Currencies time deposits published on 6 March 2021 by BOCHK and is for reference only. The preferential interest rate is a one-off privilege for each time deposit and the subsequent renewal rates of time deposits will be subject to the quotes by BOCHK from time to time.

- BOCHK reserves the right to amend, suspend or terminate the above products, services and offers, and to amend the relevant terms at any time at its sole discretion without prior notice.

- Offer is limited and available while quota lasts.

- In case of any dispute, the decision of BOCHK shall be final.

- Should there be any discrepancy between the English and Chinese versions of this promotion material, the Chinese version shall prevail.

Risk Disclosure:

- RMB investments are subject to exchange rate fluctuations which may provide both opportunities and risks. The fluctuation in the exchange rate of RMB may result in losses in the event that the customer converts RMB into HKD or other foreign currencies.

- RMB is currently not fully freely convertible. Individual customers can be offered CNH rate to conduct conversion of RMB through bank accounts and may occasionally not be able to do so fully or immediately, for which it is subject to the RMB position of the banks and their commercial decisions at that moment. Customers should consider and understand the possible impact on their liquidity of RMB funds in advance.

- Foreign currency investments are subject to exchange rate fluctuations which may provide both opportunities and risks. The fluctuation in the exchange rate of foreign currency may result in losses in the event that customer converts the foreign currency into Hong Kong dollar or other foreign currencies.

eCompareMo partners with the leading banks to provide you with impartial and up-to-date information on all financial products in the country. With our state-of-the-art time deposit calculator, you can compare and contrast all time deposit interest rates in the Philippines to find the best one that can give your investment a head start.

What is a time deposit?

A time deposit, or a certificate of time deposit, is an interest-bearing bank deposit that has a specified date of maturity. It is a bank account type option for customers who would like to deposit available excess funds in a high-interest account type. This is issued for a specified term, such as 30 days (minimum) up to five years. Funds can be withdrawn without prior notice, or before the maturity date, though there are penalties for early withdrawal.

Forms of deposit can be through cash, check (personal or managers check) and fund transfer from an existing account maintained at the same bank where the time deposit will be placed.

Why do I need to open a time deposit account?

The more money you invest in a time deposit, the more you'll earn. Also, with its better interest rates, one of the benefits of time deposit is it secures higher yields from your savings. Choose from any type of time deposits—traditional, mutual fund, fixed, term deposit with interim interest, flexible—and let your money grow.

How to open a time deposit account

Our advanced calculation engine allows users to make a fast and easy comparison of all time deposit interest rates offered by banks in the Philippines—guaranteed free. Applicants can get detailed information, such as minimum initial placement, placement term, withholding tax, rollover allowance, certificate of time deposit, and other requirements.

After doing a comparison using eCompareMo’s time deposit interest rate calculator, you can immediately invest for a time deposit online. By using our platform, you can save time and money in choosing the right time deposit account.

To open a time deposit account, all you need is a digitized ID, such as an SSS ID, Driver’s License, Voter’s ID, Company ID, and the like.

Receive top-notch support from our customer service agents

Our customer helpdesk is more than willing to answer your questions regarding the product/s of your choice. Our highly trained agents also provide you with financial advice and other information that will help you make an informed decision about time deposit.

Data security is our top priority

Your security is paramount to us, that’s why at eCompareMo, we use global standards in data privacy and security. With an encrypted data protection system, you can be sure that all your personal information is protected. We will never share any of your data with other parties without your consent.

Helping millions of Filipinos save time and money

eCompareMo helps Filipinos achieve financial freedom through financial products and services. By using our service, customers can simplify their process of searching for the best products that are tailored to their wants and needs.

Best Time Deposit Rates

Aside from financial comparison services, we also provide insightful, informative, and inspirational articles as well as social media campaigns that aim to reach out to people looking for financial freedom in their lives.

Union Bank Time Deposit Rates

With eCompareMo, opening a time deposit account in the Philippines has never been easier.