Dda Deposit

DDA is a term usually used in finance that is an abbreviation for “Demand Deposit Account”. This is a type of a checking account where the account holder can withdraw their funds “on demand”, or anytime. Oftentimes, employers like to use these types of accounts to deposit their employees’ salary.

DDA Debit Charge

In this case, DDA means “Direct Debit Authorization“. This term is usually used in USAA bank accounts.

A checking account. One may demand payment of the money on deposit without penalty. Contrast with a certificate of deposit, in which one must pay a penalty if the money is withdrawn early. The Complete Real Estate Encyclopedia by Denise L. William Evans, JD.

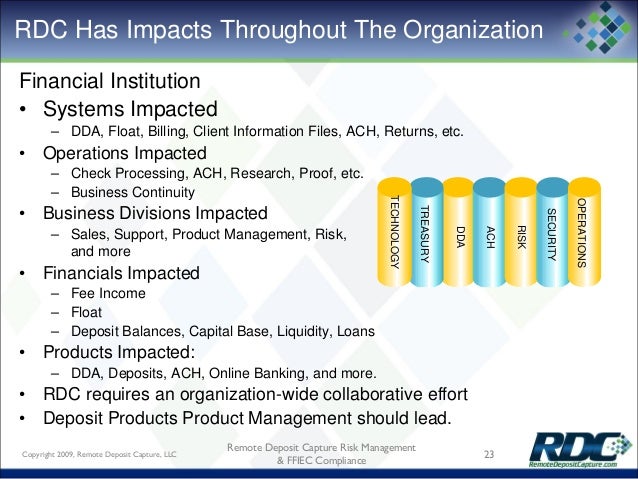

Funds in a demand deposit account. For example, NOW account holders may use negotiable instru-ments (checks), drafts, telephonic or electronic orders or instructions, or other similar devices to make payments or transfers to third persons or to others. A NOW account holder may make an unlimited number of transfers to another of his. A transaction account, also called a checking account, chequing account, current account, demand deposit account, or share draft account at credit unions, is a deposit account held at a bank or other financial institution. DDA (Deposit Data Analytics) provides a growing suite of deposit applications and services that will significantly improve the quality and extend the application of your analytics. Streamline your deposit analytics process Your entire deposit analytics process – data, analytics and output – can be streamlined and integrated, and leveraged. DDA housing scheme 2019. The Delhi Development Authority (DDA), on July 23, 2019, declared the lottery draw for 10,294 homes located in Narela and Vasant Kunj. Applicants can check the winners’ list and watch the video streaming on DDA’s official website and can check the list of shortlisted buyers.

The DDA Debit Charge is sometimes referred to as DDA Purchase or DDA Pur. It is the status of a charge that is still “pending” on your account. Once the transaction fully goes through, the name will be updated to reflect the actual charge.

It is best to check if you have any automatic payments set for that specific amount, because in most cases, it is a pre-approved transaction that is still processing.

How Demand Deposit Account Differs from Other Bank Account Types

Some individuals would go to the bank and open up a Money Market Account. This other type of bank account cannot be withdrawn whenever you want. A DDA, on the other hand, is always available for withdrawal at any time.

Dda Deposit Number

- A Demand Deposit Account has lesser interest compared to other types of bank accounts.

- If you are depositing to a bank and you think you might need it in the near future, tell your bank to open a DDA.

- DDAs can be accessed using checks, debit cards, and other electronic methods.

What Is A Dda Credit

What is DDA Credit?

Sometimes, accounts would have a negative balance or a lot of overdraft transactions. This occurrence is called DDA credit and often results to the account being closed. Most banks would automatically close accounts with DDA Credits when the negative balance is not settled within 30 days.

Some terms to take note of:

- Overdraft – When an account has greater amount of withdrawals than what was actually deposited

- Charge off – When the bank assumes that the debt or overdraft cannot be collected or paid

Foreign Currency Accounts

Demand Deposits

Dda Deposits

The same concepts as above apply if you withdraw or deposit money with a forex broker. The charge is initially displayed as a DDA charge, and then it should be updated to include the appropriate broker name.