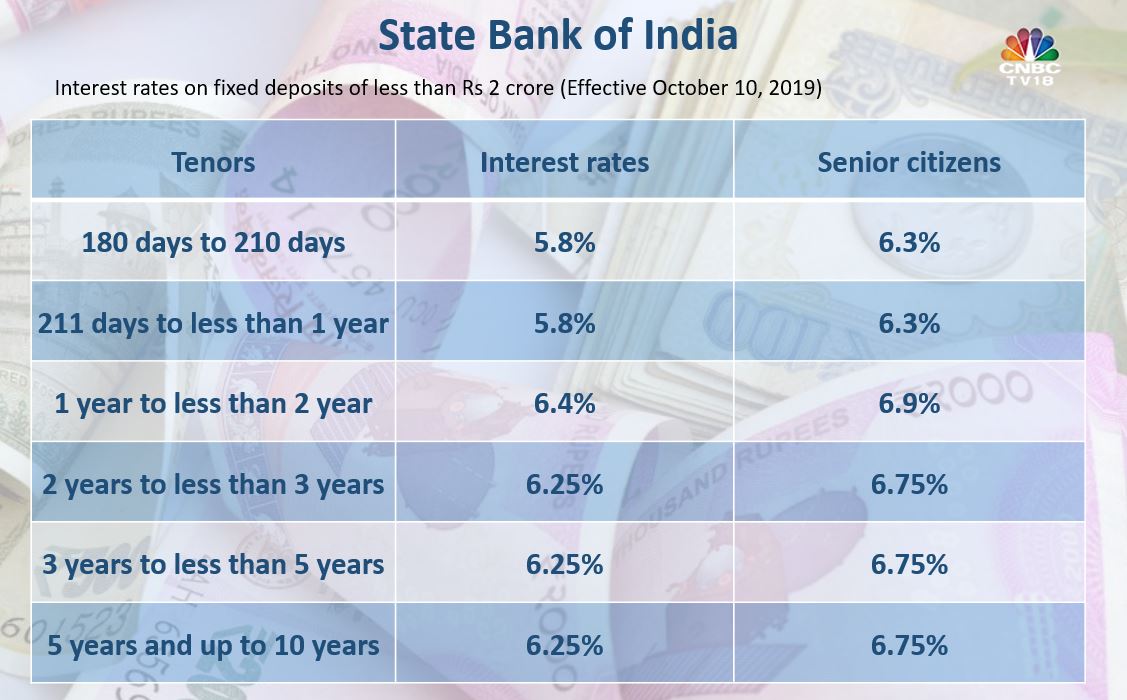

State Bank Of India Interest Rates

Accordingly, SBI home loan interest rates are linked to CIBIL score and start from 6.80 percent for loans upto Rs 30 lakh and 6.95 percent for loans above Rs 30 lakh. 'Interest concessions up to 30. The State Bank of India (SBI) has cut interest rate for home loans by 10 basis points (bps), with rates starting 6.7 per cent onwards. The bank will continue to offer 100 per cent waiver on.

State Bank Of India Interest Rates On Saving Account

Checking & Savings Accounts

Deposit Account Type | Required Minimum Balance to Open | Required Balance to Obtain the Interest Rate and APY | Interest Rate | APY1 |

|---|---|---|---|---|

Basic Business Checking Account | $100 | NA | NA | NA |

Simple Business Checking Account | $100 | NA | NA | NA |

Prime Business Checking Account | $1,500 | NA | NA | NA |

Elite Business Checking Account | $5,000 | NA | NA | NA |

Interest Business Checking Account | $2,500 | $2,500 | 0.15% | 0.15% |

Attorney Client Checking Account | $100 | $100 | 0.15% | 0.15% |

Analysis Business Checking Account | $500 | NA | NA | NA |

Business Savings Account | $500 | $500 | 0.30% | 0.30% |

Hi Yield Interest Checking Account | $100 | $100 | 0.50% | 0.50% |

Easy Checking Account | $250 | NA | NA | NA |

Senior Checking Account | $100 | NA | NA | NA |

Student Checking Account | $25 | NA | NA | NA |

Remittance Registration Checking Account | $10 | NA | NA | NA |

Regular Personal Savings Account | $100 | $100 | 0.30% | 0.30% |

Hi Yield Advantage Savings

Personal Only

Required Minimum Balance to Open: $500

Tier | Minimum Balance to Open and Obtain APY | Interest Rate | APY1 | |

|---|---|---|---|---|

Savings Balance Tier 1 | $500 | $4,999.99 | 0.15% | 0.15% |

Savings Balance Tier 2 | $5,000.00 | $9,999.99 | 0.25% | 0.25% |

Savings Balance Tier 3 | $10,000.00 | $100,000.00 | 0.30% | 0.30% |

Savings Balance Tier 4 | $100,000.01 and above | 0.35% | 0.35% | |

State Bank Of India Interest Rates 2019

Hi Yield Advantage MMDA

Personal and New Money Only

Required Minimum Balance to Open: $500

Tier | Minimum Balance to Open and Obtain APY | Interest Rate | APY1 | |

|---|---|---|---|---|

Savings Balance Tier 1 | $500 | $4,999.99 | 0.20% | 0.20% |

Savings Balance Tier 2 | $5,000.00 | $74,999.99 | 0.25% | 0.25% |

Savings Balance Tier 3 | $75,000.00 | $149,999.99 | 0.25% | 0.25% |

Savings Balance Tier 4 | $150,000.00 | $250,000.00 | 0.30% | 0.30% |

Savings Balance Tier 5 | $250,000.01 and above | 0.35% | 0.35% | |

Money Market Deposit Account (MMDA)

Personal and Business

State Bank Of India Interest Rates Nri

Required Minimum Balance to Open: $500

Tier | Minimum Balance to Open and Obtain APY | Interest Rate | APY2 | |

|---|---|---|---|---|

MMDA Balance Tier 1 | $500 | $49,999.99 | 0.15% | 0.15% |

MMDA Balance Tier 2 | $50,000.00 | $99,999.99 | 0.25% | 0.25% |

MMDA Balance Tier 3 | $100,000.00 | $249,999.99 | 0.30% | 0.30% |

MMDA Balance Tier 4 | $250,000.00 and above | 0.35% | 0.35% | |

Premium Money Market Deposit Account (MMDA)

Personal and Business

Required Minimum Balance to Open: $100,000

Tier | Minimum Balance to Open and Obtain APY | Interest Rate | APY2 | |

|---|---|---|---|---|

MMDA Balance Tier 1 | $500 | $49,999.99 | 0.20% | 0.20% |

MMDA Balance Tier 2 | $50,000.00 | $99,999.99 | 0.25% | 0.25% |

MMDA Balance Tier 3 | $100,000.00 | $249,999.99 | 0.30% | 0.30% |

MMDA Balance Tier 4 | $250,000.00 | and above | 0.35% | 0.35% |

Certificate of Deposit (CD)

Regular Deposits | Institutional Deposits | ||||

|---|---|---|---|---|---|

Term | Minimum Balance to Open and Obtain APY | Interest Rate | APY2 | Interest Rate | APY2 |

8 days to less than | $1,000.00 | 0.15% | 0.15% | 0.15% | 0.15% |

3 months to less | $1,000.00 | 0.25% | 0.25% | 0.25% | 0.25% |

6 months to less | $1,000.00 | 0.35% | 0.35% | 0.35% | 0.35% |

1 year to less | $1,000.00 | 0.50% | 0.50% | 0.50% | 0.50% |

2 years to less | $1,000.00 | 0.50% | 0.50% | 0.50% | 0.50% |

3 years to less | $1,000.00 | 0.50% | 0.50% | 0.50% | 0.50% |

4 years to less | $1,000.00 | 0.50% | 0.50% | 0.50% | 0.50% |

5 Years + | $1,000.00 | 0.50% | 0.50% | 0.50% | 0.50% |

Sbi Interest Rates Nri

| Term | Minimum Balance to Open and Obtain APY | Interest Rate | APY2 |

|---|---|---|---|

1 Year | $1,000.00 | 0.50% | 0.50% |

2 Years | $1,000.00 | 0.50% | 0.50% |

3 Years | $1,000.00 | 0.50% | 0.50% |

4 Years | $1,000.00 | 0.50% | 0.50% |

| $1,000.00 | 0.50% | 0.50% |

1APY refers to Annual Percentage Yield and is accurate as of 12/22/2020. Interest is compounded daily and paid monthly. Interest is calculated and accrued daily based on the daily collected balances in the account. The account requires a minimum opening deposit based on tier and APY and is listed above. Rates may change at any time without prior notice, before or after the account is opened. Fees could reduce earnings on the account.

2APY refers to Annual Percentage Yield and assumes interest remains on deposit until maturity. APY is accurate as of 12/22/2020. Rates are fixed for the term of CD. Interest is compounded quarterly and interest may be paid monthly, quarterly, annually or at maturity. The account requires a minimum opening deposit based on term and APY and is listed above. Interest begins to accrue on the business day you make your deposit. CD rates are subject to change at any time and are not guaranteed until CD is opened. A penalty may be imposed for early withdrawal. Fees could reduce earnings on the account.

For further information about terms and conditions, see the Personal Banking Schedule of Fees and Charges and Consumer Deposit Account Disclosure, call toll-free 1.877.707.1995, or visit a location near you.